BIAN - the Banking Industry Architecture Network

BIAN is home to more than 100 leading banks, software vendors, service providers and consultancies. Each member combines their industry expertise to define a revolutionary banking technology framework that standardises and simplifies core banking architecture.

BIAN Deliverables | Core Tools and Standards for Banking

Discover BIAN’s deliverables, including frameworks, models, and standards, designed to streamline banking operations and foster innovation in the financial sector.

About Us - BIAN

BIAN members unite their industry expertise to define a revolutionary banking technology framework that standardises and simplifies core banking architecture. This comprehensive model provides a future-proofed solution for banks, fostering industry collaboration.

Service Landscape - BIAN

Learn about the BIAN Service Landscape, a comprehensive blueprint that defines standard business processes to streamline banking operations.

BIAN Membership

Who are the BIAN Member? Please view the list of BIAN Members who approved to post the logos on the website. BIAN Members can view the entire member and collaboration list on the BIAN internal collaboration portal.

BIAN Membership - BIAN

Join the BIAN Membership today to connect, collaborate, and innovate in banking standards for a future-proof financial ecosystem.

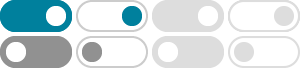

Vendor applications and in-house developed solutions needs to comply with the BIAN-based Absa standards that have been adopted when competing for business. Designed with a Microservices architectural style to :-

InSite - BIAN

Architecture overview ...

BIAN’s goal is to define standard service operations covering the working of banks (other types of financial institution may be included in time). BIAN has adopted a

BIAN develops new ‘Coreless Banking’ concept advancing banking ...

2023年9月12日 · Coreless Banking 3.0 builds upon BIAN’s second iteration of its coreless banking model developed in 2021, which included canonical service designs such as semantic APIs and underlying data schema. This concept allowed banks to modularize, standardize and develop new services more quickly in a best-of-breed environment.

- 某些结果已被删除